What makes the trains for Bhopal and Indore metro rail projects so special?

What makes the trains for Bhopal and Indore metro rail projects so special? Knorr-Bremse acquires Alstom’s Rail Signalling Technology Business at €630 million

Knorr-Bremse acquires Alstom’s Rail Signalling Technology Business at €630 million Navigating India's Metro Rail Expansion: Efficient Planning for Timely Completion

Navigating India's Metro Rail Expansion: Efficient Planning for Timely Completion Enia Design wins Design Consultancy Contract of Nagpur Metro Phase 2

Enia Design wins Design Consultancy Contract of Nagpur Metro Phase 2 Anand Bullet Train Station is poised to become a key transportation hub on MAHSR

Anand Bullet Train Station is poised to become a key transportation hub on MAHSR Sojitz-Larsen & Toubro JV bags $290mn civil contract for Jakarta's Mass Rapid Transit

Sojitz-Larsen & Toubro JV bags $290mn civil contract for Jakarta's Mass Rapid Transit RVNL signs MoU with TUMAS India for Railways and Metro Infrastructure sector

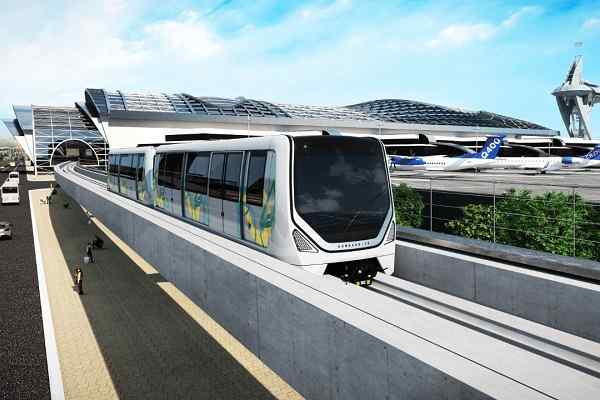

RVNL signs MoU with TUMAS India for Railways and Metro Infrastructure sector Alstom bags APM system contact for KA International Airport in Jeddah, Saudi Arabia

Alstom bags APM system contact for KA International Airport in Jeddah, Saudi Arabia Construction work commenced for Phase 2 of Taipei Metro's Green Line

Construction work commenced for Phase 2 of Taipei Metro's Green Line Global hydrogen fuel cell train market to reach $26.41 billion by 2035

Global hydrogen fuel cell train market to reach $26.41 billion by 2035

Strategy for Technology Acquisition for Rail & Metro Projects under Make in India

The current criteria for considering two million population cities qualifies 19 cities for Metro projects. In addition to DPRs for several cities with less than 2 million population are also being considered in the Ministry of Housing & Urban Affairs (MoHUA). While the requirement of funds projected in the 12th plan itself is nearly USD 22 billion, the actual investments envisaged would be more than 30 billion USD. Further MoHUA is also contemplating a policy of declaring cities with Million Plus population as eligible for Metro. Thus Metro Rails represent a multibillion dollar investment potential in India.

Need for a Procurement Policy on Metro Projects

There is justification for formulating a long term strategy on procurement of Metro systems, given the huge market India’s metro projects offer. The strategy would need to leverage the market that numerous Metro projects offers and address long term sustainability of this relatively capital intensive public transport.

At present, Metros are being procured through individual contracts. Thus leveraging of the investment size is not taking place. Unless a supplier of Rolling Stock sees a likely market for bulk supply of train-sets/ signaling systems, bidding for Metro contracts, bidding will not be aggressively competitive.

Each Metro authority calling for Rolling Stock and Signaling results in creation of a heterogeneous rolling stock fleet, with serious consequences for sustainability. Maintenance servicing and Spares for Rolling Stock and Signalling Equipment are a major component in Operation and Maintenance costs which will require a detailed consideration for future. As is the practice, the services and spare parts will become more and more expensive, once the suppliers’ original equipment manufacturers (OEMs) in Europe, Japan, Korea etc. migrate to new product versions and put the previous generation equipment in “service mode”. Availability of spare parts and maintenance services will thus become more costly and even difficult. Development of an India based OEM industry is therefore critical for sustainability when more than 19 Metros are being planned in the country.

Present Scenario not in sync with Make in India

Unlike fixed infrastructure, in the area of rolling stock and signalling, it is seen that there is considerable heterogeneity in metro technology platforms. Even when manufacturing units have been set up in India, high value items that comprise the propulsion system are mostly imported from original equipment manufacturers (OEMS) in other countries like China, Korea and EU countries, where the technology resides. Local Manufacturing provisions bring low tech assembly jobs in the country like making car bodies and bogie manufacture. As a result, limited value addition and jobs creation in high end manufacturing and technology take place within the country, despite several thousand crores being spent on metro projects from public exchequer.

Need for Standardization of Specifications

Standardization of specifications for rolling stock, signalling and development of a vendor base of OEMs in the country will facilitate larger scale procurement on a single technology platform. The need for a policy framework is also recognized by Ministry of Urban Development.

“Presently individual metros are procuring rolling stock in small quantities with different specifications and clause to manufacture 60 to 70% cars indigenously. This does not promote indigenisation of propulsion equipment which is mostly imported. As in case of car body manufacture, indigenous manufacture of complete propulsion equipment in the phased manner also needs to be mandated in the rolling stock tenders,” said the Ministry.

Urban Transportation however is a State List subject. A national level policy would be required to direct States pursuing Metro projects to procure standard specification rolling stock and signal systems.

Transfer of Technology for “Make in India” driven manufacturing hub

Rail Based Metro Transport Systems need to be viewed not merely as a transport solution but from a manufacturing perspective. Rail based transport systems require dedicated rolling stock and signalling systems for ensuring safe movement of steel wheel on steel rail. Rolling Stock and Signal systems constitute nearly 25-30% of project costs and recurring expenditure on spares is high. Thus localization of these systems can become a key driver for manufacturing in India.

transfers if used effectively, can raise the newer products like Metro Rail, High Speed Rail and Heavy Haul Freight Rail Rolling Stock, signals, Trains Control and Electrical Systems and the Rail Sector manufacturing business can expand beyond Rs 100,000 Crore.

Approach to Transfer of Technology-case study

Standardization of specifications for rolling stock, signalling and development of a vendor base of OEMs in the country will require a prior measure – Acquisition of Technology. It has to be a sustained effort, anchored in a manufacturing facility with requisite skills and knowledge and practicing engineers to absorb the Designs, Drawings and Manufacturing processes, metallurgy etc., for high cost components, with training and hand holding all the way till vendor base of OEMs is developed in the country. An example of successful ToT in the Railways has been the procurement of 6000 HP electric locomotives from ABB with full transfer of technology. Technology for production of transformers, Traction Motors, Traction Converters, Auxiliary Converter, Vehicle Electronics, Application Software (Source Code & Tools), Car Body, Bogie etc with full purchase specification for non ABB items. The results were a stunning more than 50% drop in cost of production over the price of the imported locomotives- all through localization. This spun off a large domestic vendor base of Indian OEMs.

Intercity High Speed Rail

As in the case of Metros, the High Speed Rail offers an opportunity to plan right from the beginning, in the correct direction, of imbibing advance rail technology and creating jobs in India. High Speed Rail train-sets work on distributed propulsion systems. Technology residency in Rolling stock for rail based suburban mass transit systems is available in India. Electric Multiple Unit (EMUs) and Multiple Electric Multiple Unit (MEMU) coaches running in Indian Railways’ suburban rail services work on distributed propulsion technology. Even at present, technical clearance of all Metro projects is with Railways.

However, there is need to upgrade this technology base. The transfer of technology negotiations for Metro rolling stock will further strengthen India’s capacity to step up speed of EMUs / MEMUs in India from existing levels up to 200 km/hr and facilitate introduction of faster intercity passenger services on upgraded existing tracks. Tech knowhow for Metro coaches could be developed further by Indian Railways in house R&D, in association with academia, IITs, IISCs etc. to indigenously develop high speed trainsets. Prototypes could be tested on the proposed test track.

Japanese ToT could commence with helping India set up a test track for High Speed and heavy haul rail operations. About 50 kms of different types of track for testing rolling stock prototypes developed for HSR would not cost more than 4000 cr. With this, transfer of technology, absorption of advanced rail technology involved in HSR would also be facilitated. Testing facilities and laboratories for development of prototypes could be explored. The case for Japanese Technology lies in the superior safety record and near zero mortality record, even during severe earthquake induced Rail mishaps involving high speed trains on elevated tracks.

Strategy on Transfer of Technology and Localization of Manufacturing of Rolling Stock/ Signalling systems for Rail Metro and High speed rail

JICA loans are lofferedfor Metros as STEP loans with provision for procurement of goods and services from Japan to the extent of 30%. With atleast 15 metro projects likely to be posed for funding, Japanese consortia are presented an opportunity of supplying nearly 9-10 billion USD worth rolling stock/ signalling systems on Japanese technology platform and a long term engagement of its technical consultants for life cycle maintenance.

India may seek as its own condition - complete transfer of technology for rolling stock, signalling and train control systems for metro projects under India’s “Make in India” policy, translated as high value addition in India and making a transition from lowend manufacturing towards high end manufacturing in India- more sophisticated advanced technology-intensive goods.

Under “Make in India” mission, transfer of technology will help upgrade skill sets and technology base of the country to facilitate transformation from low-end technology product manufacturing to high -tech / high-end manufacturing. The transfer of technology would entail communicating not only the designs and drawings but also the system integration and maintenance knowhow, which will eventually lead to standardisation of specifications for Metros in India. Presently the turnover of indigenous rail equipment and component manufacturing industry covering the existing rail technology products is around Rs 35,000 Crores. The new technology

Negotiations on Transfer of Technology under STEP loan, for both Metro rolling stock and High Speed train-sets, should be conducted by a multi-disciplinary team on the Make in India policy plank. Such negotiations need to be taken beyond financial closure, to ensure India’s interests are well protected. These negotiations need to be backed by a conscious national policy- creating more jobs in the country, upgrading the level of technology and manufacturing base for high end technology products, nurturing India’s GDP and providing a base for R&D in advanced rail technology products.

The negotiation team must include experts who have knowledge of critical components of the Transfer of Technology package and a dedicated team to see through the complete process of transfer of technology. The domain knowledge of experts on technology transfer and localisation, must be deployed to convince their Japanese Counterparts about the mutual benefits of collaboration in rolling stock manufacture. Japan has several companies like Kawasaki, Mitsubishi, Hitachi, Nippon Sharyo, Kinki Sharyo, Toshiba and J-TREC with expertise in Rolling Stock design and manufacture, who stand to benefit from the investment opportunity. They can form more than one consortium to satisfy the norm for inviting competitive bidding within Japan.

India may need to identify a dedicated organization with practicing engineers, capable to absorb and develop the necessary technical skills and technology from Japanese majors. In this regard, PSUs like BEML, BHEL and IR Production Units like ICF Chennai, RCF Kapurthala, Rae Bareilyetc could be useful candidates. Transfer of Technology to PSUs/ Govt bodies would give the Japanese firms an assurance that no IPR violation issues would arise. OEMs vendor base would be developed on strict non-disclosure agreements and also for domestic usage only, so that they do not compete with Japanese Companies abroad.

The strategy would be to insist that the transfer of technology be accompanied by design analysis training and hand holding in the entire production process and in understanding the vehicle guidance system and signalling system and train control systems so as to develop an understanding on how each component of the metro system integrates with the other for smooth and safe operation. Thus Transfer of Technology (ToT) Package could then also include hand holding for development of original equipment manufacturers for auxiliary convertor, traction convertor, transformer and other major high value items in the propulsion chain within India.

Japan has Heavy Haul Freight Rolling stock technology and India has interest in collaboration with Japanese Manufacturers of 12,000 HP and 9000 HP Locomotives to be used for freight operations including in Dedicated Freight Corridors. Loans for DFC must take advantage of simultaneous transfer of technology and manufacture in India with emphasis on vendor development as Original Equipment Manufacturers and Original Design Manufacturers (OEMs / ODMs) in India. Such localization should reach at least 70% of the value of rolling stock, as suggested by DIPP, within 3-4 years of ToT. Even in heavy haul wagon design we may explore Japanese technical assistance.

Delhi-Mumbai Industrial Corridor offers a unique opportunity for setting up Green Field Projects- International Class Planning and Logistics are some of the features which will attract green field OEMs manufacturers in this region. India stands to gain through such a package as on the one hand we get a cheap loan and on the other hand the transfer technology package will ensure imbibing high end technology for further mass production and supply of spares to feed the growing demand for metro rolling stock and signalling in the country. Thus jobs will be created in India instead of Indian money (through loan/public exchequer accounts) being spent on imports from Korea and China etc.

Issues to be resolved

Having established the case for technology residency in India for Metro and HSR rolling stock, signalling systems with system integration knowhow, the following issues also would need to be addressed.

Globally advanced rail technology products are monopolised by a few nations. These nations jealously hoard commercial innovation products. This invariably creates stubborn cartels, even in competitive bidding. Ordinarily, ODAs, ECBs or multilateral funding agencies loans will finance only procurement of Rolling Stock/ Signalling equipment etc. but not transfer of technology. Advanced technology holding Donor nations will not part with such technologies, unless they sight gigantic infrastructure investments opportunities backed by markets. Thus a conscious policy decision has to be taken at the national level on procuring, through international bidding route, on loan funds- Metro and HSR rolling stock, signalling systems etc.

Ordinarily a STEP Loan too will not accommodate an advanced technology transfer, unless both the donor and recipient nations perceive such advanced technology transfer as a strategic necessity. JICA loans are being offered for Metros as STEP loans with provision for procurement of goods and services from Japan to the extent of 30%.

With atleast 8-9 metro projects likely to be posed for funding, Japanese consortia are presented an opportunity of supplying more than 2.5 billion USD worth rolling stock/ signalling systems alone, on Japanese technology platform and a long term engagement of its technical consultants for life cycle maintenance. Through subtle negotiations, India may seek as its own condition- complete transfer of technology for rolling stock, signalling and train control systems for metro projects under India’s “Make in India” policy, translated as high value addition in India and making a transition from low-end manufacturing towards high end manufacturing in India- more sophisticated advanced technology-intensive goods. This is an imperative from the point of view of affordable sustainability of this public transport. Similar would be the case for high speed trains.

Competitive bidding benefits will have to be matched with the benefits accruing to the nation from STEP loan over the life cycle of the loan. While a multilateral Agency loan will permit price discovery benefits to accrue, the all in cost of loan debt servicing of a multilateral agency lending could be higher than a STEP loan, when compared on the scale of benefit of lower interest rates and transfer of technology package.

A word on Foreign Direct Investment in Metros and High Speed Rail. FDI- does not automatically bring in technology transfer of high value, high end technology products, unless there is a national policy on compulsory substantial localization. Sustainability issues in high speed trains and Metros will require local indigenous production and development of Indian OEMs. Thus a government negotiated transfer of technology package may be necessary for metros and HSR.

(This article is part of our May 2022 issue of Metro Rail Today Magazine)